Top Sectors to Watch + The 18 SMA Setup Every Trader Should Know

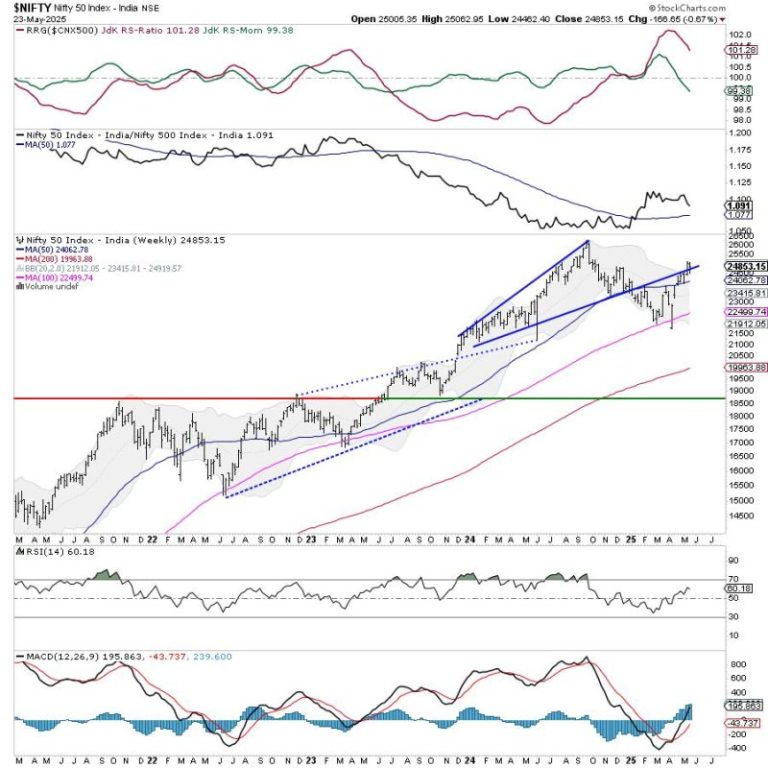

In this video, Joe analyzes which sectors to focus on when selecting new stocks. He demonstrates how to use the 18-period simple moving average (SMA) on monthly, weekly, and daily charts to identify the strongest stock patterns and the best timeframes to trade. He then provides chart analysis on the QQQ, IWM, and Bitcoin, before...

Read more