Is This the Confidence Trap That Could Wreck Your Retirement Portfolio?

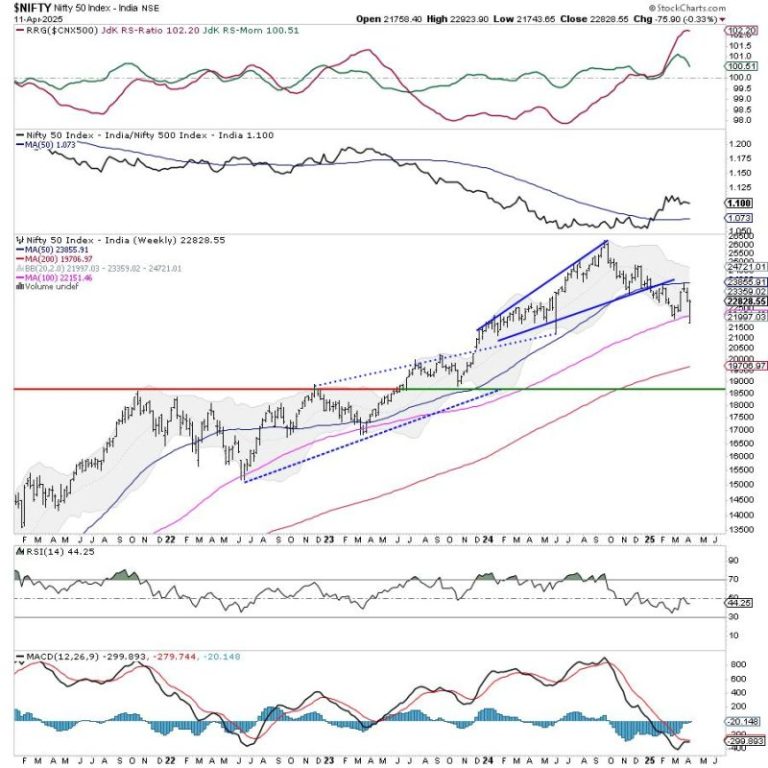

If last weekend’s tech tariff exemptions teach us anything, it’s this: trying to make near-term market forecasts based on tariff assumptions is a fool’s errand. But that leaves a big question for active investors near or in retirement: How do you make smart decisions when the market’s running on chaos? On Monday morning, when all...

Read more