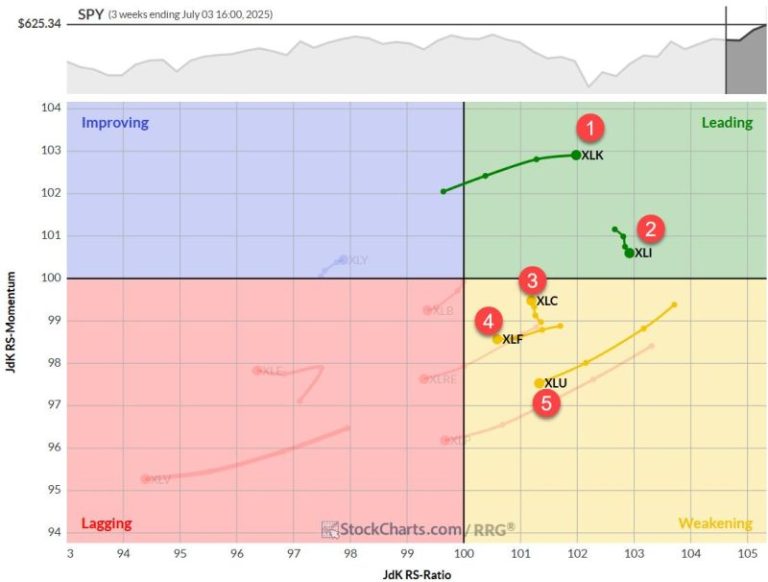

The Seasonality Trend Driving XLK and XLI to New Highs

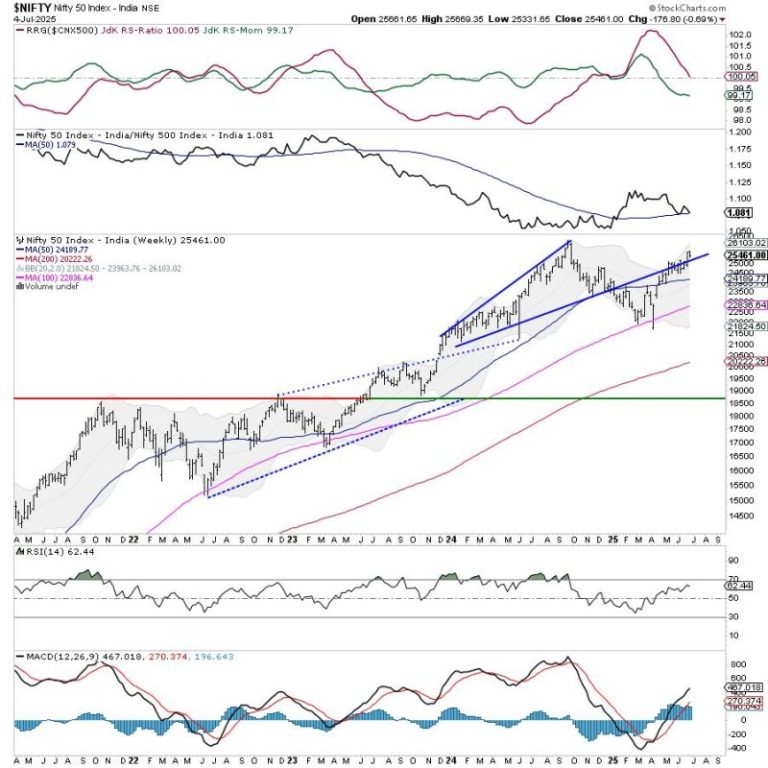

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you’re probably wondering: Amid the current “risk-on” sentiment, even with ongoing economic and geopolitical uncertainties, can seasonality help you better anticipate shifts in sector performance? Current Sector Performance Relative to SPY To find out, let’s first look...

Read more